Construction Tech — The Bits and Atoms Transforming our Physical Spaces

How Startups are Reconstructing our Built Environment

The construction of physical structures has been executed by a coterie of craftsmen for millennia. The scientific breakthroughs of the 17th century sparked an age of experimentation that enabled architects and engineers to build with a wide array of materials and forms. This era precipitated a wave of change in building large scale, permanent structures that would be felt for centuries to come.

Today, physical structures are inextricably woven into all aspects of our lives. Where we go to school, work, eat, sleep, and even where we retain most of our wealth. Real estate is the thread that makes up the fabric of the American economy. Home equity is the single largest financial asset for Americans, the construction industry supports nearly 10 million jobs in the U.S, housing makes up nearly 17% of GDP, and more people want to sell these physical structures than ever before.

Despite its size, stature, and tenure, the construction industry is often maligned as the industry that technology left behind. As the world has gotten more efficient, U.S. construction labor productivity has lagged overall labor productivity. As every major industry has changed around us, the places that we have spent greater than 2/3 of our lives in haven’t. The industry has seen cost, complexity, and variability go up while innovation has fallen behind.

Proptech is technology built for the real estate industry. It has loosely been around since the 1980’s and in 2023 it touches a menagerie of functions pre, mid, and post construction. Construction tech, is a subsector which has begun to gain traction, in part due to the successful adoption of other proptech technologies over the last decade. Due to these adjacent successes, growing numbers of investors and operators are pioneering a new wave of opportunity for construction tech startups.

In a past industry overview I dove into a related and also very antiquated space, Urban Planning. Today, I explore the all infatuating sector of construction tech.

A Brief History of Construction Tech

Industrial Revolution

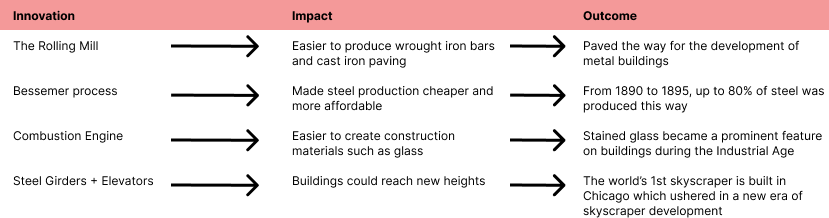

Prior to the late 18th century, construction relied heavily on manual labor and basic hand tools. The industrial revolution brought power-driven machines that revolutionized materials and processes and brought newfound capabilities to the building process.

In addition to all the major innovations listed above, there was a new, crazy idea that that captured the zeitgeist of the industrial revolution—what if you could manufacture a house like all the other products of the time?

In 1849 they did just that and created “kit houses” which contained all the pre-built components needed to make a house. These kit houses were then shipped by rail for those building settlements during the California Gold Rush to assemble. As the American population was quickly expanding West, where there were very few established settlements and the need for prefabricated and affordable housing was desperately needed. In 1908 Sears launched a mail-order “Modern Homes” program with the same concept. They went on to sell more than 70,000.

The PC Golden Era of Construction

Post World War II, demand for housing exploded in the U.S. and manufactured a decades long construction boom. This demand side surge paired with the introduction of the PC in 1984, acted as a forcing function for builders to adopt technology to keep up with growing consumer appetite. If materials and process were the theme of innovation of the industrial revolution, innovation in the 20th century would be summarized primarily by innovation in project design, architecture, and communications.

Design and Architecture: PCs impacted construction technology significantly because builders and their clients could now design, share, and scan projects using software. Computer Aided Design (CAD) emerged during this time, replacing the manual drafting of designs and enabling the development, modification, and optimization of the design process. Building Information Management (BIM) also got its start in the late 50’s allowing architects, engineers, contractors, and subcontractors to collaborate on the fine details of design and construction by using the same database and computer model.

Communication: Email and mobile phones made it possible for project teams to communicate easily, especially when working from different locations.

Lagging Innovation over the Last Two decades

What is the theme of innovation across the start of the 21st century? Thus far, it has been more about the expansion and revival of existing technologies, than net new creation.

Pre-fabricated (pre-fab) homes which have recently garnered media attention for being “The Future of Real Estate” have also quite literally been the past. Although an old concept, it has been forgotten in recent years because the stigma of pre-fab homes that originated in the 1960’s decimated the category. As the rush to build post WWII housing was winding down, everyone woke up one day, looked around, and realized that mobile homes made up 15% of the nations housing supply. Oof. The space became stigmatized and forgotten as the need for quick and cheap housing production had passed. In 2023, the modern resurgence of prefab homes have gotten a much needed facelift and are appealing to a growing number of home buyers/builders.

Source: Cover The cloud transition has enabled greater adoption of the CAD and BIM technologies of the 80’s and further enabled more effective and efficient communication mechanisms.

Advanced Materials like reinforced concrete, although novel have been an expansion of existing commonly used materials, concrete and steel. The innovation in this case is the combination of the two, which has unlocked new types of building, previously not possible.

Addressable Issues with Construction

It is becoming harder to build

Widespread labor and talent shortages, shrinking margins, cumbersome approval processes, broken supply chains, and higher interest rates for project loans all point to the same conclusion… it is becoming harder to build our physical structures.

Not enough homes exist today

As of July 2023, there exists a meaningful supply side housing shortage across the U.S, spurred, in part, by a housing construction slowdown over the past decade. To be fair, the surge in home buying due to the low interest rates of the Covid-19 Pandemic didn’t help much either. As of the start of 2023, the U.S had a shortage of 6.5 million single family homes.

Constructions Environmental Impact

Worldwide it is estimated that the construction industry generates about half of all carbon emissions. Some key characteristics contributing to negative environmental impact from construction include:

Cities can no longer sprawl endlessly into rural land.

“The total area covered by the world’s cities is set to triple in the next 40 years – eating up farmland and threatening the planet’s sustainability.”

Construction creates ALOT of waste. Its estimated that 50% of landfills are made up by waste from the construction sector.

U.S. Homes are too big, and getting bigger.

“The median square footage of an American house built in the nineteen-sixties was fifteen hundred square feet, compared with about twenty-two hundred today—and the earlier model was home to more people

High Energy Consumption of Buildings. The construction industry uses more energy than the industrial or transportation sectors. Buildings account for 40% of all energy consumption in the U.S.

Reinforced concrete contributes 78% of the total carbon emissions of building.

The Opportunity to Build Better

Construction is crucial to the survival of human kind. It will always exist, but the way and rate in which it improves is up to the technologists and industry expert operators. There is a sizeable opportunity for these pioneers to envision new ways of constructing our built environment to be more efficient, cost effective, and have less of an environmental impact.

Market Opportunity

As a $12 trillion global industry, architecture, engineering, and construction (AEC) is one of the largest global industries, yet it has been among the slowest to innovate.

“The construction industry is the largest in the world, in terms of dollars spent, yet we are the least productive in terms of technological adoption and productivity gains” - David Jason Gerber

Over the last few years there has been increased attention to the sector given the potential alpha of the opportunity. From a value perspective, it is expected that 45% of the industry’s value chain will shift from traditional processes in the next 15 years. Investors believe that this is shift is possible and it is seen in the numbers. It estimated $50 billion was invested in AEC tech between 2020 to 2022, 85% higher than the previous three years.

So where is this capital flowing to? Who are those that are seizing the opportunity in the burgeoning industry of Construction tech?

Startups Building Technology to Change our Built Environment

Homebuilders

There are a growing number of startups innovating on the standard home building process. They are offering cheaper prices, more transparency, less waste, quicker timelines, and are increasing accessibility to custom designed homes.

Atmos is a home-building platform to built to assist in the creation and design of customized houses. The company is constructing a managed marketplace for homebuilding, connecting home buyers to homes. It has raised $18.7 million in total funding.

Veev is a tech-led, vertically integrated home builder that leverages a digital architectural & structural design process, full panelized manufacturing, and on-site installation. It says it can build housing four times faster than traditional firms. Veev also has a home operating system offering create room-specific lighting, shade, and climate control and also offers protection against intrusion and cybercrime. It has raised $597 million in total funding.

Welcome is a online home building platform that makes buying a new home simple by streamlining the entire new home construction journey from land selection to customization to construction. It has raised $35.4 million in total funding.

Homebound is a technology enabled, full stack home builder that is addressing the need to build more homes in more scalable and customer centric ways. Homebound leverages external labor markets to reduce the the time to build a home while also simplifying the customer journey through its online platform. It has raised $128.4 million as of 2023. I wrote a full deep dive into Homebound for Contrary here.

Homma is a tech-enabled home builder that specializes in designing modern homes focused on modern, healthy living. Homma builds custom hardware, software, and sources quality materials allowing them to simplify construction timelines. Homma has raised $31.9 million as of 2023.

Additions and Renovations:

Startups are also changing the way additions and renovations occur. They are providing streamlined customer experiences, tools for contractors to scale, allowing for more collaborative design processes, and more.

Block Renovations is a renovation platform that combines architect-grade design, construction labor, and materials into a streamlined online renovation experience. It has raised $104.5 million as of 2023.

Source: Block Renovations Made is a architecture and planning company that specializes in home renovation. It provides managed services that combine design, materials, and construction into a single, stress-free home renovation experience. Made has raised a $9 million seed in 2020.

Cottage is a SaaS-enabled marketplace that allows homeowners to design online, get upfront pricing and access vetted contractors who run their business on its platform. It is starting with Accessory Dwelling Units (ADUs). It has raised $18.5 million as of 2023.

Eano, delivers custom design and build solutions, including architectural designs, ADUs, bathrooms, kitchens, floorings and custom projects for homeowners. For architects and contractors, it provide tools to help them scale more efficiently and reach more customers. It has raised $17.2 million as of 2023.

Prefab/Modular Homes

Traditionally, pre-fabricated homes have felt like building houses on a film set—resulting in Truman Show-esque look and feel. Pre-fab startups today are solving home customization at scale, while also maintaining the efficiency, cost, and limited waste benefits that come with traditional modular building.

Cover is a tech company that designs, manufactures, and installs custom Backyard Studios. Its software creates a digital 3D model of each custom studio then it manufacture the home in its Los Angeles factory using a high-precision quality-controlled manufacturing processes. It has raised $73.3 million as of 2023.

Source: Architectural Digest, per Cover Abdou is a prefab home builder that builds backyard homes, constructed offsite, and installed in homeowner backyards. It has raised $23.5 million as of 2023.

Multi-family/mixed use

Cities can no longer sprawl endlessly into rural land. Startups focused on providing dense housing enables the creation of walkable and energy efficient communities.

Blokable is a modular home builder for multi-family properties. It provides a vertically integrated solution to create housing at scale through the use of modular units, aka “bloks”. Blockable has raised $35.9 million in funding.

Juno develops residential apartment buildings intended to offer environmentally friendly and fast housing alternatives. It has developed a proprietary prefab building system that uses repeatable components that can be easily configured or adapted to suit a specific site or local codes. It has raised $31.3 million in total funding.

Prescient is a technology and manufacturing company that offers a cost-effective alternative to conventional building structures. Prescient's develops multi-unit buildings and residential construction, including apartments, condos, senior and assisted living communities, hotels, and college and military dormitories. It has raised $295 million across six rounds of funding.

Other early companies include Woho, Fullstack Modular

3D Printing

3D printing addresses some of the major issues with construction today; cost, customizability, and time to build. Homes fully built using industrial-sized 3D printers can be made in less than 24 hours.

Branch Technologies: Is a tech company that develops 3D printed and cellular fabrication technologies and products. It combines additive manufacturing, prefabrication and digital technology at construction scale. It has raised $19.8 million as of 2023.

Source: Branch Technologies Mighty Buildings is using 3D printing, robotics, and automation to a less wasteful, faster, and more automated approach to build homes. It has raised $101.8 million as of 2023.

ICON 3D prints homes using robotics, software, and advanced materials. ICON utilizes its construction technologies on both earth and lunar surfaces. It has raised $451.5 million. Icon claims that it can produce a 600 to 800-square-foot, economy-sized building for as low as $4,000 in 24 hours.

Source: Icon

Risks

Regionality Constraints

Most construction tech startups have started on the west coast and are regionally focused on warm regions with limited precipitation and weather variability. Proof of concepts that were successful in LA will have difficulty translating to the variability of climate on the east coast. Additionally zoning, licensing, and regulations differ locally so market expansion is much more complex. Most construction tech startups have been hyper selective about market expansion. The above constraints make national expansion complex and less scalable, especially when comparing to pureplay software businesses.

Business Models and Pricing

The construction industry broadly is characterized by high pricing and a lack of transparency. Although many of the startups have aimed to fix the inherent intricacies of construction pricing, which is impacted by geography, topography, supply of labor, materials, etc, most have not. Those that have generalized pricing in optimizing for transparency, have come at the cost of appearing priced extremely out of market ie:

The average size home in the U.S. in 2021 was 2,480 square feet and the average price per square foot ranges ~$120 to ~$744, depending on the state. All of the pricing examples above would rank in the 98-100 percentile in average price per square foot in the U.S. Hawaii ranked higher, for only a few specific models, as seen in the graphic below.

Although not an apples to apples comparison, ADUs or Tiny home kits are sold for can be found for a fraction of the price. To note, the majority are DIY, some only include the framing, etc.

From a business model perspective, the capital intensity has been a point of contention for many investors. VCs want things that scale at zero marginal cost, which describes software, not building physical structures.

Broad Approaches = Lack of Focus

Many construction tech startups are doing a lot across the full stack of customer needs. From buying land, designing, building, financing, and even insuring the home some startups are taking touching every point of the customer journey in an attempt to provide as much value as possible. Katerra tried to do some variation of this by attempting to become the Salesforce of construction. Its goal was to be a one-stop-shop, vertically integrated, construction project management company. In hindsight, its early lack of focus introduced a lot of complexity while at the same time created very little actual value. $2 billion was invested into Katerra over its lifetime, more investment than any other private company in the construction industry over the past five years. Kattera would go on to file for bankruptcy six years after its founding date.

Stylistic Uniformity

This risk is one that only occurs if startups win and construction tech eats the world. The risk of stylistic uniformity is seen in the globalization of building styles all across the world. This is occurring already, but as more buildings are built by startups there is risk of further uniformity across styles, materials, and aesthetics, resulting in everywhere just looking the same. Glass-and-steel monoliths have already replaced local architecture, but any future hopes to preserve local techniques and styles goes against fundamentally what startups need to be successful at scale. This wonderful twitter thread explains this concept better than I ever could.

Final Thoughts

As construction tech continues to evolve, it holds the potential to reshape the way we create physical spaces, fostering efficiency, sustainability, and innovative design. While the journey ahead is marked with challenges, the construction tech industry is poised to shape the future of construction, merging technology and physical spaces in novel, non-consensus, and impactful ways.

Further Down the Rabbit Hole

aka Links to other cool stuff

All of Block Renovations Completed Projects

Proptech Traction

Veev’s Product Page

Homebound’s Overview of Custom Homes

Proptech Investors 2023 POV per Techcrunch

NPR on the Housing Shortage